There’s insurance coverage for almost anything, from health insurance for people and pet insurance for furry friends to homeowners insurance and car insurance. Travel insurance is a good idea anytime you take a trip, especially if you consider yourself a frequent traveler. Insured travelers have the peace of mind of cancellation coverage, protection from non-refundable trip expenses, medical coverage, and more. Like any insurance plan you need to understand why insurance options are a good deal. Read on to discover some of the things that you probably didn’t know you could claim on travel insurance.

1. Adventure Fails

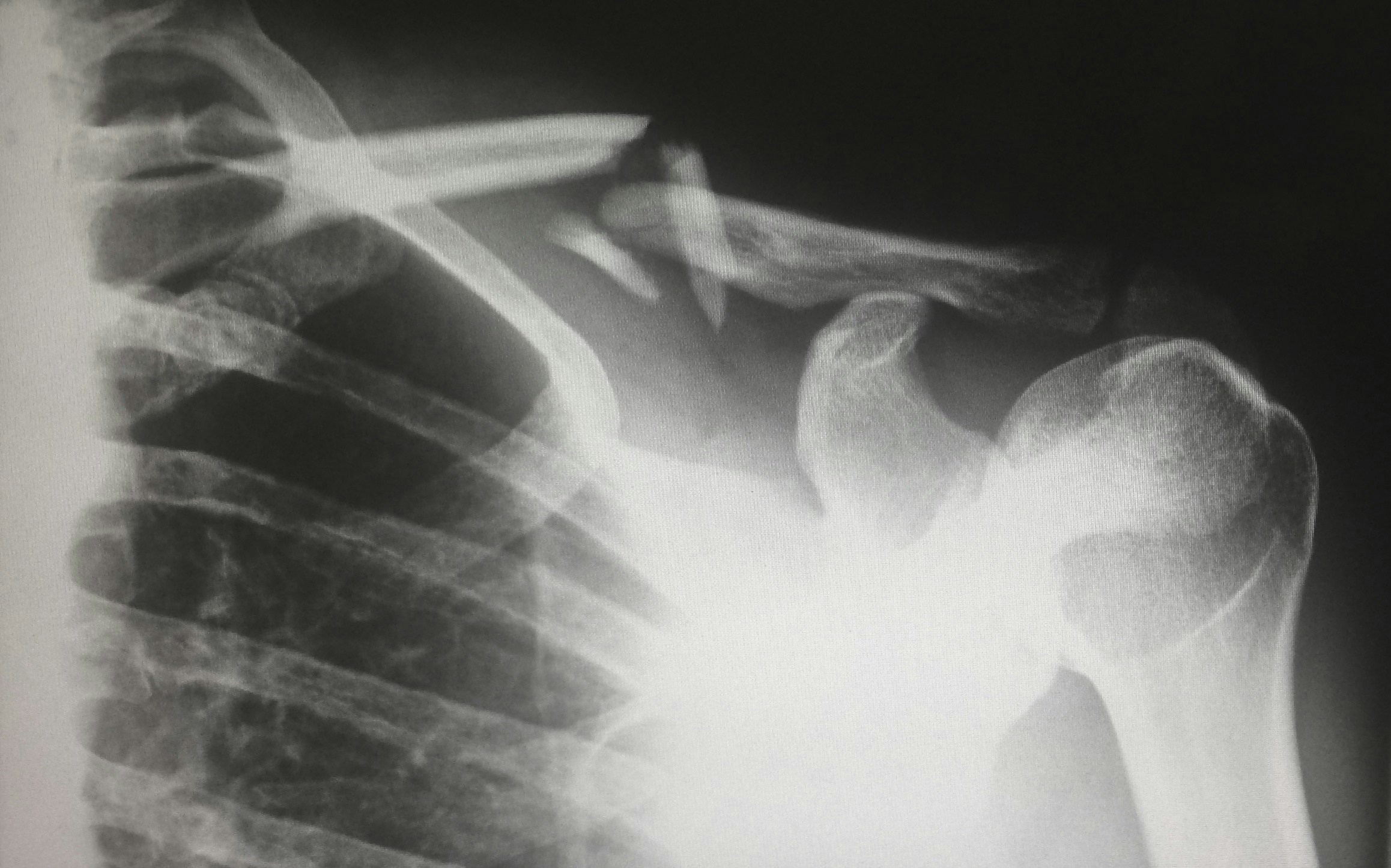

What’s a destination vacation without a little adventure? Thrill-seekers can participate in many a strange and thrilling activity with the peace of mind knowing that they are insured for injuries. Try zorbing, go mud-buggying, or give riding a camel, elephant, or ostrich a shot knowing that your travel insurance covers trips to the hospital for injuries.

It’s a good idea to make sure that your travel insurance covers injuries you cause to others. An innocent victim who gets in the way of your adventure activity could hold you liable for their medical bills.

2. Injury or Sickness Abroad

Medical emergencies happen on vacation and the last thing you want to worry about is paying for medical expenses. Luckily, if you were to fall ill while on a cruise and find yourself confined to your cabin, your travel insurer may cover any expenses incurred. These means small overseas medical claims, doctor’s visits, medicine, and medical treatment.

Every travel insurance policy is different, from basic plans to comprehensive coverage. When you are making travel plans it’s a good idea to compare different travel insurance plans to find the best policy for your needs. Travel insurance covers you for unforeseen circumstances when you travel. Medical expenses, luggage, personal belongings, trip delay, lost or stolen credit cards, and canceled flights can all be covered with travel insurance. In some instances when natural disasters interrupt your plans or cause trip cancellation, these costs may be covered.

Trip insurance is a great idea for frequent travelers and world nomads who don’t want to worry about how to deal with a worst-case scenario while abroad. iSelect.com.au allows travelers to compare travel insurance policies online to find the right type of coverage for their next trip. When you find the best travel insurance company for you, be sure to check the Product Disclosure Statement (PDS) and read the fine print to understand all inclusions, exclusions, and policy limitations before purchasing.

3. Lost Bookings and Personal Property

Did you know that if you miss a stop on a cruise itinerary that you can receive compensation for missed ports with interruption coverage? Any interruption that causes you to lose pre-booked travel plans should be refunded by your insurance policy. This includes flight delays, lost baggage, and bad weather.

Let’s say you are interacting with a local animal, feeding it, or trying to snap a selfie with it. The animal reacts and you drop your phone or camera and lose some expensive sunglasses. Your travel insurance may cover the loss of your personal belongings while traveling.

4. Travel Service Let-Down

If you book your travel arrangements through a tour company and the service doesn’t uphold their end, travel insurance can refund additional travel costs that you put out to reach your destination. If you need to arrange alternative transport and get a rental car, for example, your insurance plan should cover the additional costs.

5. Cancelation Due to Extenuating Circumstances

Life doesn’t stop just because you are planning to go on vacation. Sometimes the unexpected happens and you have to cancel your travel plans due to extenuating circumstances. Home break-ins, jury duty, or redundancy at work should all fall under trip cancellation coverage so that you can claim the cost of travel bookings. You take out medical insurance and homeowners or renters insurance to protect you from the unexpected, so why not take out an annual travel insurance policy to keep you protected from the unexpected abroad?

Before you set off on your next trip, take out a travel insurance policy to keep your out-of-pocket expenses protected while you are away from your home country.